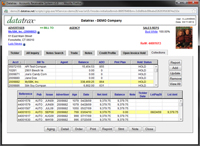

About Credit and Collections

Datatrax® integrated Credit & Collection features help publishers both improve the quality of the receivables and speed the collection of revenues. Credit limits/rules by Account provide better management of Advertiser activities and credit levels, as well as credit processes. The Notes feature allows collectors to record their latest communication with debtor and add Ticklers for next follow-up on promises to pay or other payment arrangements. Datatrax® provides ability to set up payment plans with Advertisers or Agencies, develop calendars for tracking collection agency performance and record both payments received to-date and costs incurred against the funds collected. Datatrax® Credit and Collection analysis reports include: Dunning/Collection letters, Over Credit Limit Audit and Collection Agency Performance report.

Credit and Collections Features & Benefits

Standard Features

- Account level credit rules

- On demand printing and/or emailing of Invoices and Statements

- Compute and post finance charges on specified accounts

- Credit Holds and Automatic warning on Accounts over Credit Limit

- Automatic Credit Hold for all accounts exceeding Credit Rules

- Credit Limit reports, 30, 60, 90 day notices, and Dunning Letters

- Track Collection Agent performance

- Credit and Collection tasks